-

Recent Posts

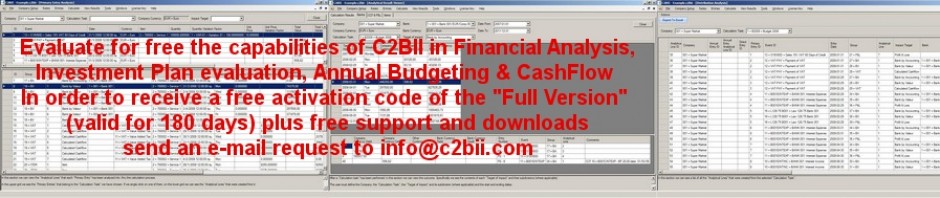

- How do we evaluate an “Investment Plan”? The opinion of the “Average Joe off the street”

- Calculation of profitability: The devil is in the details. Can 0.05% create an unacceptably high error margin?

- What is the basis of the method of C2BII? Part 7: Processing of “What if” scenarios thru “Variation Factors”

- What is the basis of the method of C2BII? Part 6: CashFlows that will take place only if a predetermined criterion has been met

- What is the basis of the method of C2BII? Part 5: Forecasted and Calculated figures – Curing Inaccuracies and Inconsistencies

Recent Comments

- How do we evaluate an “Investment Plan”? The opinion of the “Average Joe off the street” | CEO on Financial Analysis on Financial Analysis: Possibly the two biggest words that you thought you knew, but in reality they practically almost didn’t exist

- What is the basis of the method of C2BII? Part 6: CashFlows that will take place only if a predetermined criterion has been met | CEO on Financial Analysis on What is the basis of the method of C2BII? Part 5: Forecasted and Calculated figures – Curing Inaccuracies and Inconsistencies

- What is the basis of the method of C2BII? Part 5: Forecasted and Calculated figures – Curing Inaccuracies and Inconsistencies | CEO on Financial Analysis on What is the basis of the method of C2BII? Part 4: Analytical Lines

- RealTime - Questions: "What is a Spreadsheet?" on A Financial Analyst’s wish list Part 1: Attack of the multicolored spreadsheet

- seanlopez on Problems of “Net Present Value” Part 3: Example of a totally illogical result, when used in a “Company based scenario”

Archives

Categories

Meta

Category Archives: Financial Analysis Method

How do we evaluate an “Investment Plan”? The opinion of the “Average Joe off the street”

The best way to evaluate an Investment Plan Continue reading

Posted in Budget, Budgeting, C2BII Instructions, Financial Analysis, Financial Analysis Method, Investment Plan Evaluation, Problems of Net Present Value

Tagged Budget, Budgeting, C2BII Instructions, Financial Analysis, Financial Analysis Method, Investment Plan Evaluation, Problems of Net Present Value

Leave a comment

Calculation of profitability: The devil is in the details. Can 0.05% create an unacceptably high error margin?

An abismally small percentage can create a huge and unacceptable error margin in the calculation of profitability of an Investment Plan Continue reading

What is the basis of the method of C2BII? Part 7: Processing of “What if” scenarios thru “Variation Factors”

C2BII: How to handle the calculations of the business uncertainty. Processing of “What if” scenarios thru “Variation Factors” Continue reading