In an “Annual Budget”, or in an “Investment Plan Evaluation”, some incidents (and the CashFlows that result from them) are subject to a forecast. Examples are sales, ads, rent, salaries (only under specific circumstances) etc. Some other incidents should never be subject to a forecast, but should always be a product of a verifiable calculation. Examples are “VAT Payment”, “Interest Income”, “Interest Expense”, purchases (raw materials, packaging materials, merchandise etc), “Income Tax”, other Taxes, “Direct Labor Salaries”, “Social Security” etc.

Let me explain this a little more. In an oversimplified example, let us say that someone has made the following forecasts:

- Forecasted Sales with 19% VAT = 1,000,000€

- Forecasted Purchases with 19% VAT = 800,000€

- Forecasted Payment of VAT to Government = 40,000€

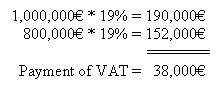

Creating a forecast for the “VAT Payment”, to begin with, is redundant and (almost always) dangerous and misleading. The thing is that when someone has said that sales are going to be 1,000,000€ and purchases are going to be 800,000€, then (for all practical reasons and purposes) that person has already said the equivalent of:

So, we have a person that says 40,000 while at the same time, his/hers data say 38,000. This is not simply an inaccuracy. It is much worse. This is an inconsistency, which is one of the most lethal sins in science.

An inexperienced person might think that this is the sort of mistake that nobody with a decent IQ could ever make in a million years. If life (and conducting business) was as simple as the above oversimplified example, then I would have agreed too.

However, a sample of the real life list of steps that are needed to create that “VAT Payment” calculation, and the issues that need to be factored in, might look like this:

- The volume of forecasted Sales, needs to be broken down among the days of the forecasting period (week or month or Fiscal Year)

- Each daily volume of sales must be backtracked to a date of production, using the company’s policy for “levels (i.e. days) of stocks of finished goods”.

- Each volume of daily production must be backtracked to a date of purchase of raw materials and packaging materials, using the company’s policy for “levels (i.e. days) of stocks of raw materials and packaging materials”.

- A volume of daily purchased raw materials and packaging materials should be established, on the basis of the “Bill of Materials” of the Item for which we have created the above mentioned Sales forecasts.

- The volume of daily purchases of raw materials and packaging materials must be increased by a factor that reflects the “production waste” and the “quality control rejections of finished goods”.

- The sum of each specific month’s “VAT Payment”, is the difference between that specific month’s “VAT of Sales” minus that specific month’s “VAT of Purchases”.

- If a month’s calculated “finishing balance” of the VAT account is a debit value (which results in “non payment of VAT” for that specific month), then that debit balance must be incorporated into the next month’s VAT calculation.

And this is just a sample list of the many issues in the calculation of “VAT Payment” of the “Annual Budget” or of an “Investment Plan”. Please note that in all the above mentioned calculations, the key issue is “daily calculation” of values. Now that you have seen part of the real picture, that “VAT Payment” calculation doesn’t seem that simple anymore, does it?

And if you think that calculating the “VAT Payment” is complicated, wait till you see the list of issues that must be addressed for the calculation of “Interest Income” and “Interest Expense”. Hint: among other things, we must establish “Calculated Daily Balances” of the Bank Account (not a “Monthly Average” balance) and we must also take into consideration the “Days of Valeur” of each individual transaction. And after all these calculation issues have been correctly factored in, only then we can start talking about the issues of the “Income Tax” calculation (an even more demanding and complicated process).

I have seen way too many incidents of people creating forecasts for “VAT Payments”, “Interest Income”, “Interest Expense”, “Income Tax” etc, as a means of taking a shortcut. In their defense, I understand that correctly conducting all the calculations that are relevant, by using a spreadsheet, is an unimaginably difficult, time consuming and prone to casual error endeavor, up to the limit that in most of the cases, it is impractical to perform. However, this understanding cannot be used as vindication and justification for not creating a calculation whose results can stand up to scrutiny and verification.

A few weeks ago, in a private conversation that I had with a Venture Capitalist, I heard him say that he is sick and tired of seeing MBA holders who create Business Plans that have little to no proximity to an accurate calculation of profitability, due to inaccurate (or even entirely omitted) calculations of miscellaneous values, such as the VAT Payment etc. I felt no hesitation to reply to the effect that I also shared his resentment.

So, bottom line, any accurate method of conducting Financial Analysis must have provisions and mechanisms for the creation of “Calculated Values” from “Forecasted Values”. Stick around and we are going to see how C2BII addresses this issue in an accurate and easy to understand and implement way.

Pingback: What is the basis of the method of C2BII? Part 6: CashFlows that will take place only if a predetermined criterion has been met | CEO on Financial Analysis