Suppose that you are not an Accounting & Finance professional, and you would like to learn about “Investment Plan Evaluation”. You are planning to create a new company from scratch. You have amassed lists about forecasted sales, purchases, salaries, ads, rent etc. What you need to find now, is a method to process those figures, in order to come up with the answer to the most obvious and the most useful question in such a situation, which is “Profit & Loss”.

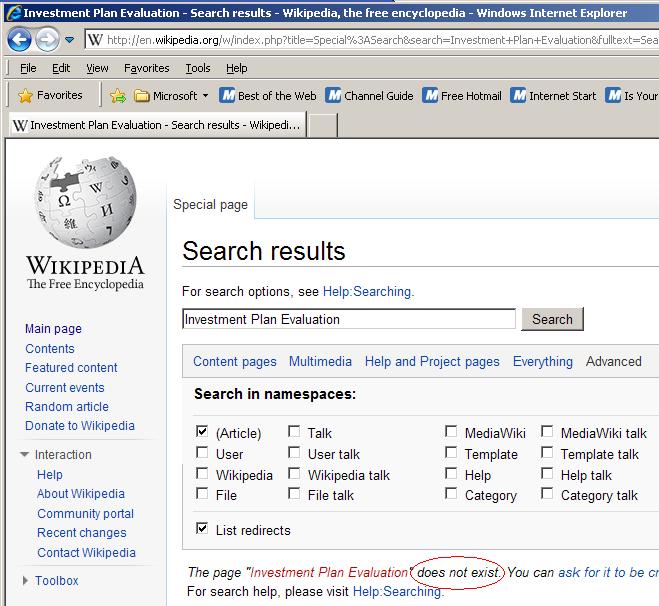

In the 21st century, the usual starting place for such a search would be Wikipedia, which currently has over 4 million English articles. The first surprise will surely come when you find out that there is no article in Wikipedia about “Investment Evaluation” or “Investment Plan Evaluation” or “Evaluation of an Investment” or any other variation on the search words. If you open any of the articles that Wikipedia presents to you as potentially relevant, you will find that they are totally irrelevant to the task at hand.

This will probably be a first class shock to you. After all, “Investment Evaluation” is part of the curriculum of MBA. Every year, dozens of thousands of students get taught the subject. Yet none of them (or any of their professors) had anything to write that would meet Wikipedia’s criteria for publication? Is it possible that the reality in the state-of-the-art in Financial Analysis calculation methods is so problematic?

If you try to google for “Financial Analysis Software” or “Investment Evaluation Program” or anything along those lines, you will get flooded with result pages. However, on a closer look, you will see that they are about programs that calculate the monthly payments of Bank loans (most of them in connection with real estate situations), or ones that do analysis of statistical ratios, or ones that have something to do with the stock market, or statistical report generators.

In my personal searches (before the creation of C2BII), I was not able to find a single software application that attempted to answer the most obvious and most useful question: “Profit & Loss”. The reason for that is that an accurate and reliable method to calculate that result (one that can pass scrutiny and verification) had not existed before C2BII. The obvious limitation is that a method to calculate the result must preexist, and then comes the software application that implements that method. No method in existence, equals no software in existence. The calculation method of Net Present Value, which was previously considered as the state-of-the-art, is so inaccurate and problematic, that one cannot really base a decision on it. Accordingly, it is not fit as a “method basis” for software creation.

By now, I’m sure that you begin to realize that something is terribly wrong in the kingdom of Financial Analysis. This blog intends to point out those problems in detail, and then explain how easily they can be solved thru the new method of C2BII.

Stick around, because in the next series of articles, we are going to poke holes into the credibility of the “Net Present Value” method.

Pingback: How do we evaluate an “Investment Plan”? The opinion of the “Average Joe off the street” | CEO on Financial Analysis